Home sales at the national level continue to spin their wheels.

On the existing-home front, sales dropped 0.6% to an annual rate of 4.92 million units in March. When we look back to October 2012, we see that sales have, for the most part, plateaued.

Of course, when we speak of plateauing existing-home sales, we invariably speak of plateauing inventory. Supply, in fact, remains low at 4.7 months at the current sales pace. Only 30,000 units were added in March, which is 70,000 shy of the historical average March increase of 100,000 units.

The silver lining in this frustrating sales cloud is that low supply coupled with rising demand equals rising prices. Year over year, the median price is up a very stout 11.8%, which is on par with the boom days of 2005. (So we shouldn't expect the current price trend to hold indefinitely).

New-home sales also appear to be going nowhere fast. That said, they are at least lurching forward. New-home sales rose 1.5% to an annual rate of 417,000 units in March. Unfortunately, the increase was still 2,000 units short of what most economists had expected.

Supply is also tight in the new-home market. The number of new homes for sale rose by 3,000 units for March, but that wasn't enough to materially increase inventory, which remains at a low 4.4-months supply at the going sales pace.

Curiously, the median price of a new home at the national level fell 6.8% to $247,000. We are not particularly concerned, though; weaker pricing likely reflects a change in compensation – higher sales of lower priced homes – rather than a material change in overall demand.

So constrained inventory is an obvious issue, but so is tight credit, particularly for higher-amount non-conforming loans.

Rates remain very low, and have been very low for the past year, but we've yet to see a material pick up in purchase-application activity.

Uncertainty and risk – two subjects we've addressed repeatedly in the past six months – are by far the key constraints. Sequestration, regulation, taxes, Obamacare is to name a few of the most obvious uncertainty contributors.

When the perception of uncertainty is reduced, the economy grows, jobs become more plentiful, and lenders and regulators become less risk averse. Unfortunately, uncertainty remains elevated, and as long as it remains elevated the economy will continue to sputter and hiccup along.

Courtesy of Jessica Regan.

Search all Harrisburg PA homes for sale.

When you are buying or selling property in today's Harrisburg PA real estate market, it's important to have confidence in your real estate professional. Don’s commitment as your Harrisburg PA REALTOR® is to provide you with the specialized real estate service you deserve.

When you are an informed buyer or seller, you'll make the best decisions for the most important purchase or sale in your lifetime. That's why Don’s goal is to keep you informed on trends in Harrisburg PA real estate. With property values continuing to rise, real estate is a sound investment for now and for the future.

As a local area expert with knowledge of Harrisburg PA area communities, Don’s objective is to work diligently to assist you in meeting your real estate goals.

If you are considering buying or selling a home or would just like to have additional information about real estate in your area, please don't hesitate to call me at (717) 657-8700, complete my online form, or e-mail me at don@donroth.com.

Positive Conversations

We can extend the conversation of uncertainty to mortgage-bond investors, particularly those in the private market. Public officials and private pundits alike have commented on the need for private money – which is virtually nonexistent – to return to the mortgage market. Private money matters, because it means a more diverse, more inclusive mortgage-lending market.

A recent New York Times article points out that there have been few private mortgage-bond deals in recent years. The reason is the banks that sell mortgage-backed bonds are waiting for regulators to finish drawing up rules aimed at strengthening the market.

The hold-up centers on loan down payments. Private lenders want more leeway on down payments, so private bonds can be issued on mortgages with lower down payment requirements. Regulators have balked at the request in the past, but today it appears they are more willing to compromise. Regulators are being pressured by lenders and consumer advocates. Both sides have cautioned against stringent down-payment requirements, arguing that restrictions would limit lending.

The regulators are listening, and that’s good news, because if they listen and act on what they hear, we could see lending extended to potential borrowers who are champing at the bit to get in the market and buy a home.

Courtesy of Jessica Regan.

Search all Harrisburg PA homes for sale.

When you are buying or selling property in today's Harrisburg PA real estate market, it's important to have confidence in your real estate professional. Don’s commitment as your Harrisburg PA REALTOR® is to provide you with the specialized real estate service you deserve.

When you are an informed buyer or seller, you'll make the best decisions for the most important purchase or sale in your lifetime. That's why Don’s goal is to keep you informed on trends in Harrisburg PA real estate. With property values continuing to rise, real estate is a sound investment for now and for the future.

As a local area expert with knowledge of Harrisburg PA area communities, Don’s objective is to work diligently to assist you in meeting your real estate goals.

If you are considering buying or selling a home or would just like to have additional information about real estate in your area, please don't hesitate to call me at (717) 657-8700, complete my online form, or e-mail me at don@donroth.com.

It’s a question that plagues nearly every homeowner who’s ready to move on: When is the best time to put my house on the market?

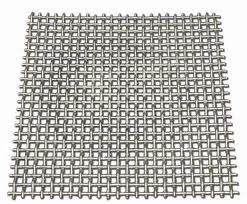

It’s a question that plagues nearly every homeowner who’s ready to move on: When is the best time to put my house on the market? Remove your screens. For best screen-cleaning results, remove your screens from the window before getting started. If you’re just trying to clean your screens quickly, and they aren’t too bad (think 1-2 on the dirt scale), it’s okay to leave them in the window. You won’t get every nook and cranny clean, but it’s better than doing nothing. If your screens are any dirtier than that, we definitely recommend removing them from the window. Otherwise, you won’t be able to remove the large chunks of dirt (plus it will make a big mess).

Remove your screens. For best screen-cleaning results, remove your screens from the window before getting started. If you’re just trying to clean your screens quickly, and they aren’t too bad (think 1-2 on the dirt scale), it’s okay to leave them in the window. You won’t get every nook and cranny clean, but it’s better than doing nothing. If your screens are any dirtier than that, we definitely recommend removing them from the window. Otherwise, you won’t be able to remove the large chunks of dirt (plus it will make a big mess). community.

community.